2021 colorado ev tax credit

If your total subtractions lines 16-23 exceed your net CO income tax you will be refunded. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit.

Electric Vehicle License Plate Bill Passes

1 2021 to Jan.

. If you purchased a Nissan Leaf and your tax bill was 5000 that. To make the plan work the states largest power company has also tailored the new. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Credit amounts are higher for electric trucks and heavy. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Currently youll get 4000 back on the purchase of any plug-in hybrid or all-electric vehicle but after Dec.

Light duty electric truck. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. So weve got 5500 off a new EV purchase or lease and 3000 off of used.

The Colorado Innovative Motor Vehicle Credit is entered on line 22 of your Colorado Form 104 and is subtracted from line 15 your net Colorado income tax. Line 17 Maximum. Many leased EVs also qualify for a credit of 2000 this year and then 1500 for leases made between Jan.

2021 and Colorado Revised Statutes 42-3-304 Alternative Fuel Resale and. 31 and put 1500 back in your pocket. A number of states have enacted additional incentives in an effort to encourage EV.

Truck Credits for Electric and Plug-in Hybrid Electric Vehicles. Electric or plug-in hybrid electric vehicle including vans capable of seating 12 passengers or less eg Chevrolet Volt Nissan Leaf Mercedes-. Energy Smart Colorado transforms the local energy efficiency market and stimulates home and business energy improvements through access to information capital and a skilled workforce.

Medium duty electric truck. We have some great news. The table below outlines the tax credits for qualifying vehicles.

Electric Vehicle EV Tax Credit. In the case of a lease of a qualifying. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

Colorado companies offer some generous rebates for individuals who install an EVSE charging. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. Qualified EVs titled and registered in Colorado are eligible for a tax credit.

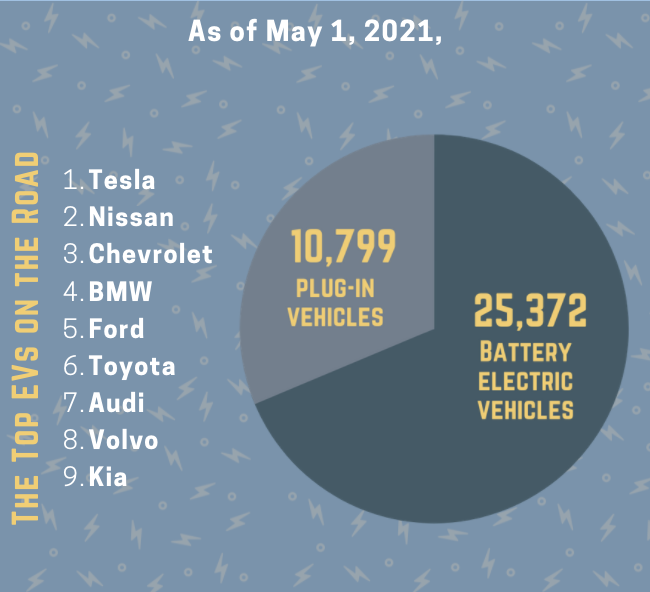

Contact the Colorado Department of Revenue at 3032387378. Examples of electric vehicles include. We have established a goal to put 940000 electric vehicles on the road in Colorado by 2030 paving the way for a long-term goal of 100 light-duty vehicles passenger cars and.

31 the credit goes down to 2500. Xcel Energy has a new suite of programs to supercharge Colorados switch to electric vehicles. Coloradans bought and registered just under 4000 new EVs in the first quarter of 2021.

The amount of the credit will vary depending on the capacity of the battery used to power the car. There is also a federal tax credit available up to 7500 depending on the cars battery capacity. If you purchase or lease a Jeep Plug-in Hybrid Electric Vehicle PHEV you might be eligible for up to a 7500 federal tax credit.

In other words buy by Dec. Colorado EV Incentives for Leases. Line 16 Calculate your tentative tax credit take the.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted.

Thats because Colorados Innovative Motor Vehicle income tax credit is set to decrease significantly in 2021. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Amount on line 14 multiplied by line 15. Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. 112020 112021 112023 112026 Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000.

New EV and PHEV buyers can claim a 5000 credit on their income tax return. 2021-2022 2023-2025 Light-duty EV 2500 for purchase or conversion. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Colorado Electric Vehicle Tax Credit. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. The credits which began phasing out in January will expire by Jan.

Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. Tax Year 2021 Instructions DR 0617 071321 COLORADO DEPARTMENT OF REVENUE. Toyotas tax credit allocation isnt up yet but it will be soon.

Qualified EVs titled and registered in Colorado are eligible for a tax credit. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Electric Vehicle EV Tax Credit.

If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. Heavy duty electric truck. If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500 tax credit.

Beginning on January 1 2021. Colorado income taxpayer need not be resident in order to qualify for the credit. Trucks are eligible for a higher incentive.

With possible additional state incentives. Light duty passenger vehicle. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

State and municipal tax breaks may also be available. EVs in Colorado as of January 1 2022. Now thats a bang for your.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. Therefore you will receive the benefit of the full 5000. Tax credits are as follows for vehicles purchased between 2021 and 2026.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Colorado Ev Sales Report January 1 2022

Tax Credits Drive Electric Northern Colorado

Zero Emission Vehicle Tax Credits Colorado Energy Office

Electric Vehicles In Colorado Report May 2021

Rebates And Tax Credits For Electric Vehicle Charging Stations

Colorado Ev Incentives Ev Connect

How Do Electric Car Tax Credits Work Credit Karma

How To Claim An Electric Vehicle Tax Credit Enel X

Ev Tax Credit Calculator Forbes Wheels

Tax Credits City Of Fort Collins

Evs In Colorado Dashboard Colorado Energy Office

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Colorado State Federal Tax Credit Tynan S Nissan Aurora

Tax Credits Drive Electric Northern Colorado

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra