tax deductions for high income earners 2019

A donor-advised fund is like a charitable investment account. Standard Deduction for 2019.

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

The Standard Deduction is an amount every taxpayer is allowed take as a deduction from their income to reduce their taxable income.

. For example if your income is 80000 and you have 20000 worth of tax deductions your taxable income is 60000. 12200 Unmarried individuals. Common Schedule 1 deductions for 2021 are.

Previously called above-the-line tax deductions taxpayers can take certain deductions on the 1040 Schedule 1 form. Tax deductions lower the amount of your income that will be subject to taxation. Whereas that deduction used to be unlimited its now capped at 10000 a year.

Premium Federal Tax Software. It would look like the following. Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income.

Tax deductions for high income earners 2019 Saturday February 12 2022 Edit. Understand The Major Changes. Max Out Your Retirement Contributions.

In Georgia however the deduction is. For individual coverage the limit is 3650. 2020 Contribution Limit.

Selling Inherited Real Estate. All Extras are Included. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019.

One of the best ways for high earners to make charitable contributions is to establish a donor-advised fund. Standard deduction of 24000 Second Year. Ad 4 Ways Your Tax Filing Will Be Different Next Year.

24400 Married filing jointly and surviving spouses. You may take an itemized deduction for contributions of money or property to a tax-qualified charity. Federal tax brackets on wages go from 10 percent for the lowest earner to 37 percent for.

100 Free Federal for Old Tax Returns. Roth IRAs are incredibly attractive as they have tax-deferred growth and tax-free distributions in retirement. For example you have until April 15 2020 to make your 2019 contributions.

Standard deduction of 24000 Fourth Year. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies. For family coverage the limit is 7200.

For individual coverage the limit is 3600. 9 Ways for High Earners to Reduce Taxable Income 2022 1. 1 2019 the maximum earnings that will be subject to the Social Security payroll tax will increase by 4500 to 132900up from.

You can make contributions for the calendar year up until the tax filing deadline for that year. When you inherit real estate particularly states with community property rules you get a full step up in basis making your property tax go up. Another tax reduction strategy for high income earners that is not yet fully understood by a lot of people is selling off inherited real estate.

The age for Required Minimum Distributions RMDs from retirement accounts was raised to 72. The article below was updated on Dec. The Tax Cuts and Jobs Act the tax reform legislation passed in December made major changes to the tax law including.

18350 Head of Household. For family coverage the limit is 7300. Taxpayers can deduct the part of their medical and dental expenses thats more than 75 percent of their adjusted gross income.

If you are self-employed read more tax hacks here. Lets start with retirement accounts. Itemized Deduction of 60000.

You can deduct up to 60 percent of your adjusted gross income each year for gifts of money. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. Check For the Latest Updates and Resources Throughout The Tax Season.

Itemized deduction of 60000 50000 charitable giving 10000 SALT Third Year. Sell Inherited Real Estate. Many higher earners are up in arms due to changes in the SALT state and local tax deduction.

Employer-based accounts such as 401 k and 403 b accounts allow you. State and local taxes. The law limits the deduction of state and local income sales and property taxes to a combined total deduction of 10000.

10 Easy Ways To Save Income Tax In India Income Tax Ways To Save Tax High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan. Additional catch-up contribution if youre 50 or older on the last day of the year. The amount is 5000 for married taxpayers filing separate returns.

But for many high earners they. The SECURE Act. Ad Prepare your 2019 state tax 1799.

If youre 55 or older you have the option of adding an extra 1000 to your contributions. 12200 Married filing separately.

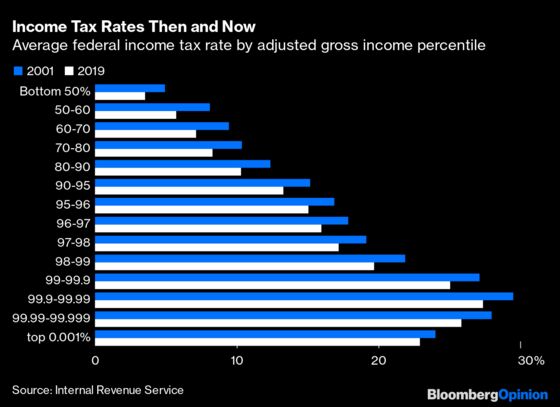

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Publication 590 B 2019 Distributions From Individual Retirement Arrangements Iras Internal Revenue Ser Online Dating Apps Best Dating Apps Dating Quotes

Why It Matters In Paying Taxes Doing Business World Bank Group

How U S Income Tax Policy Became Mostly About The 1

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Mega Backdoor Roth Roth Investing Finance

Average U S Income Tax Rate By Income Percentile 2019 Statista

How The Tcja Tax Law Affects Your Personal Finances

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pdf Personal Income Tax As A Tool For Implementing State Social Policy

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

How Does The Deduction For State And Local Taxes Work Tax Policy Center